State-owned Union Bank of India on Tuesday (June 11) said its board of directors has greenlit a capital raising plan of up to ₹10,000 crore. This includes raising equity capital of ₹6,000 crore through various avenues like public issues, rights issues, private placements, and preferential allotment.

"Raising of equity capital not exceeding ₹6,000 crore in tranche(s) within the overall limit of ₹10,000 crore, through public issue (i.e. Further Public Offer) and/or Rights Issue and/or private placements including Qualified Institutions Placements and/or Preferential Allotment or a combination(s) thereof to any eligible institutions and/or through any other modes)," according to a stock exchange filing.

Further, the bank aims to raise ₹2,000 crore each through Basel III compliant Additional Tier 1 (AT1) and Tier 2 bonds. This move is subject to regulatory approvals and aims to bolster the bank's capital base for growth and compliance.

Also Read: SEBI greenlights Ola Electric's ₹5,500-crore IPO

Union Bank of India reported an 18.36% growth in its consolidated net profit for the March quarter to ₹3,328 crore, helped by lower provisions. For the fiscal 2023-24, the lender reported a consolidated net profit of ₹13,797 crore against ₹8,512 crore in the year-ago period.

In the quarter under review, its standalone net profit increased to ₹3,311 crore from ₹2,782 crore a year ago. The core net interest income grew 14.38% to ₹9,437 crore on an 11.7% growth in advances and a widening of the net interest margin to 3.10% from 2.97% in the year-ago period.

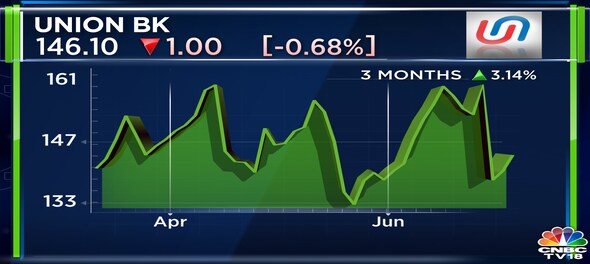

Shares of Union Bank of India Ltd ended at ₹146.10, down by ₹1, or 0.68%, on the BSE.

Also Read: Murugappa flagship Tube Investments and its arm secure ₹160-crore investment from GEF for EV funding